pa inheritance tax family exemption

The family exemption is generally payable from the probate estate and in certain instances may be paid from the decedents trust. The family exemption is 3500.

How To Minimize Or Avoid Pennsylvania Inheritance Tax Retirement Planning

Are fully deductible for Pennsylvania Inheritance Tax purposes.

. This exemption is portable. What is the family exemption and how much can be claimed. Effective for estates of decedents dying after June 30 2012 certain farm land and other agricultural property are.

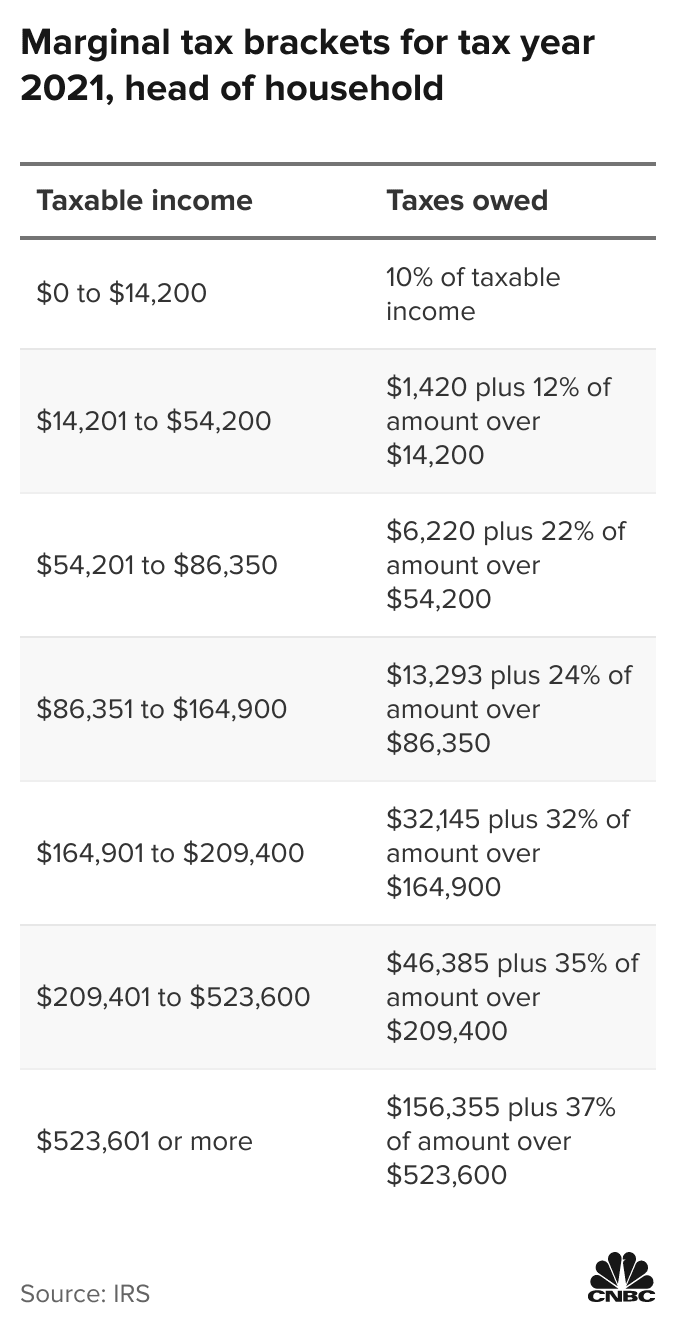

45 for a lineal descendant or ancestor 12 for a sibling and 15 for other taxable recipients. Pennsylvania has an Inheritance Tax that applies in general to transfers resulting from a persons death. However if your business meets the definition of a qualified family-owned business interest QFOBI and the transfer is to a qualified transferee QT your estate will not pay.

Reported on a Pennsylvania Inheritance Tax Return REV 1500 filed within 9 months of the decedents date of death or within 15 months of the decedents date of. Bureau of IndIvIdual Taxes. Effective July 1 2013 a small business exemption from inheritance tax is available for a transfer of a qualified family-owned business interest to one or more qualified transferees or to a trust for the sole benefit of members of the same family of the decedent.

Pennsylvania Inheritance Tax Safe Deposit Boxes. HarrIsBurg Pa 17128-0601. The family exemption is allowed against assets passed with or without a will.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. To exempt inheritanc ny other a e statute d the broth estors and oing and t r legal ado ame family was claime of Revenue the seven f agricultur any year e been paid ents death tatepaus mily or lea d principal or leased the exempt ildings not the followi ing campin s fish cat ctivities. The rates for Pennsylvania inheritance tax are as follows.

There is a federal estate tax that may apply and Pennsylvania does have an inheritance tax. Ad Check For The Latest Updates And Resources Throughout The Tax Season. The exemption is limited to qualified family-owned business interests defined as having fewer than 50 full-time equivalent employees a net book value of assets.

Questions Answered Every 9 Seconds. REV-1197 -- Schedule AU -- Agricultural Use Exemptions. If there is no spouse or if the spouse has forfeited hisher rights then any child of the decedent who is a member of the same household as the decedent may claim the exemption.

For example if your business is valued at 250000 and is transferred to your children then the PA Inheritance Tax would be 45 of 250000 or 11250. As a result Act 85 of 2012 provides an inheritance tax exemption for real estate devoted to the business of agriculture to members of the same family in hopes to keep the agricultural culture and family farms intact for future generations. The family exemption is a right given to specific individuals to retain or claim certain types of a decedents property in accordance with Section 3121 of the Probate Estate and Fiduciaries Code.

This group is known as. Expenses incurred in administering real property held in the decedents name alone are allowed in. This group is known as Class A.

Qualified Family-Owned Business Exemption REV-571 Author. From June 27 1974 through January 29 1995 the amount of the family. There is still a federal estate tax.

Get your free copy of The 15-Minute Financial Plan from Fisher Investments. Transfers to grandparents parents descendants which include adopted and step-descendants are subject to a 45 inheritance tax. For decedents dying after January 29 1995 the family exemption is 3500.

The tax rate depends on the relationship of the recipient to the decedent ie 0 for a spouse or parent of child under age 21. Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning. Discover Helpful Information And Resources On Taxes From AARP.

The rates for Pennsylvania inheritance tax are as follows. REV-1313 -- Application for Refund of Pennsylvania InheritanceEstate Tax. 29 1995 the family exemption is 3500.

Last year Pennsylvania eliminated the tax on the inheritance of agricultural real estate by family members provided the property continues to be devoted to agriculture for a period of 7 years. Pennsylvania also allows a family exemption deduc-tion of 3500 paid to a member of the immediate family living with the decedent at the time of death. For decedents dying after Jan.

Pennsylvania imposes an inheritance death tax on assets inherited by children and other non-spouse family members. The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania. Under the qualified family-owned business exemption 72 PS.

Charitable Deduction For Federal Estate Tax purposes a deduction is allowed for charitable bequests. REV-1381 -- StocksBonds Inventory. Property owned jointly between spouses is exempt from inheritance tax.

The family exemption is a right given to specific individuals to retain or claim certain types of a decedents property in accordance with Section 3121 of the Probate Estate and Fiduciaries Code. The inheritance tax rates range from 45 to 15. The federal estate tax exemption is 1170 million in 2021 and 1206 million in 2022.

What is the inheritance tax rate in Pennsylvania. PA Department of Revenue. 0 percent on transfers to a surviving spouse to a parent from a child aged 21 or younger and to or.

Dont leave your 500K legacy to the government. In the event there is no spouse or child the exemption may be. Use this schedule to report a business interest for which you claim an exemption from inheritance tax.

Transfers to siblings half-siblings by blood or adoption but not step-siblings are subject to a 12 inheritance tax. Provided that after the transfer the family-owned business interest continues to be owned by a qualified. REV-714 -- Register of Wills Monthly Report.

Ad A Tax Agent Will Answer in Minutes. This means that with the right legal maneuvering a married couple can protect up to 2236. Ad Get free estate planning strategies.

As the family exemption under the Probate Estates and Fiduciaries Code. Real estate e tax purpo ssets of th efines me. In order to qualify for the tax exemption certain qualifications need to be met.

REV-720 -- Inheritance Tax General Information.

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Single Vs Head Of Household How It Affects Your Tax Return

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

Understanding Inheritance Tax Liens On Real Estate Stock Leader

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Fire Was Up 61 Y O Y From Higher Volumes As Well As Tariff Hikes The General Insurance Industry R Insurance Industry Health Insurance Companies Car Insurance

The Best Place To Save For Long Term Care Expenses

Naming A Trust As Beneficiary Of A Retirement Plan Retirement Planning How To Plan Estate Planning

Pennsylvania Inheritance Tax Rates And Exemptions

The State Of The Inheritance Tax In New Jersey The Cpa Journal

Pennsylvania Estate Tax Everything You Need To Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Estate Tax Panning For Married Couples Using Estate Tax Exemptions

Pa Tax Exemption For Family Owned Businesses Supinka Supinka Pc